The government makes plenty of excuses for New Zealand’s poor recent GDP growth. Unfortunately for its excuses, data exist.

National’s economic team has made an artform of making excuses. They are earnest and self-confident and mocking of those who dare disagree. But the economic ground they stand on is made of quicksand. Eventually, their excuses will swallow them as New Zealanders come to realize they are being conned.

The two most often cited excuses from National for New Zealand’s woeful economic performance - average growth of only 0.5% per year since taking office - are the Global Financial Crisis and the Christchurch earthquakes. Let’s take them in turn. (Programming note: The bigger revelation is about the earthquakes.)

Excuse 1: The Global Financial Crisis

National has over-egged the pudding on this excuse. Certainly, the GFC does serve as an explanation as to why international growth rates, and by extension the New Zealand growth rate, are lower than their historical average. No question about that.

But the GFC does not explain why New Zealand’s growth rate has been low compared to other countries experiencing the same GFC. As I showed last week, for example, Australia has outgrown New Zealand by nearly five to one since National took office, while the US and Canada outperformed us by more than 2.5 to one. In fact, you would expect New Zealand to have an advantage over the US in dealing with the GFC, because our domestic banking system did not face the same crisis as theirs. Despite that advantage, New Zealand has performed poorly.

New Zealand has, however, grown faster than many countries in the Eurozone, largely because the risk of Greece and others defaulting on their government debts has wreaked havoc across the continent. It is pretty rich for National to take credit for New Zealand’s low government debt, however, when it spent much of the last decade decrying the debt-reducing surpluses consistently run by Labour, and more recently has been borrowing for tax cuts.

National’s GFC excuse simply cannot explain why New Zealand is performing so much worse than the other non-European OECD countries. We are at the bottom of that league table, and National doesn't appear to understand why.

Excuse 2: The Christchurch earthquakes

There is a long-running battle among economists about whether disasters like earthquakes, floods, or wars are at all bad for GDP. Some well-reputed economists contend they often are not, because all the economic activity involved in fighting a war or cleaning up after an earthquake more than makes up for the output destroyed by the disaster itself. That is not to say earthquakes are good things – simply to note that one of the quirks/flaws with GDP as a measure of economic health is that is doesn’t necessarily treat bad things as negatives.

I go into more detail on this in my book about New Zealand’s tax system, but for an illustration consider what happens if you set your letterbox on fire and buy another one. “GDP” does not care at all about the burned letterbox, and it will even count as positive any kerosene you bought to burn it with. But it certainly counts as positive the new letterbox you bought, along with the petrol you used to get to the letterbox shop and so on. Even though you end up in exactly the same place as you started, GDP figures will indicate the economy has grown as a result of your actions.

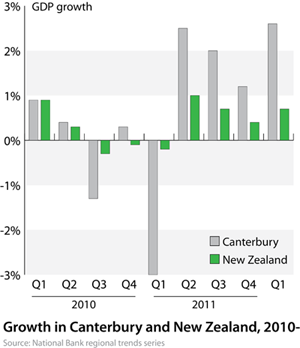

With the Christchurch earthquakes, we can look at the data directly to see whether the earthquakes caused a medium-term drain on our economy or not. The National Bank complies an excellent series on regional GDP, and we can use this to compare changes in Canterbury’s GDP with changes in the country overall, using the National Bank’s figures for consistency.

First, there are indeed obvious slumps in Canterbury’s GDP that coincide with the two most major earthquakes. But in the quarters after the second quake, Canterbury has massively outperformed the rest of the country. This is almost certainly due to various rebuilding efforts, as there is little evidence - either on this chart or elsewhere in the National Bank's historical data - of Canterbury outperforming the country before the quakes struck.

In fact, over the whole nine-quarter period starting in January 2010, Canterbury’s GDP has grown by 5.3% compared to New Zealand’s 4.6%. Yes, you read that right. Canterbury has been growing faster than New Zealand.

These data show that the earthquakes were not a drain on New Zealand’s GDP growth. If anything, Canterbury has been a source of high growth during National’s time in office.

In addition, the data show that the immediate negative impact of the earthquakes was more of less confined to the Canterbury region. Nationwide growth was little affected by either quake – the larger second quake, for example, coincided with only a 0.1% decline in nationwide growth.

National’s earthquake-based excuse making is based on simplistic economics and is not consistent with the data.

Finally, from the department of I-told-you-so, yesterday marked the first time that John Key seized on the new, actually depressing Stats New Zealand growth figures to proclaim that “the last quarter of negative growth we had was in 2009, before, actually, Bill English delivered his Budget.” This is yet more evidence that the government will trot out any figure, no matter how facile, to make itself look like a good economic steward and will make any excuse, no matter how flimsy, to avoid its own failures.

National Ministers obviously expect to be able to keep up this charade for the next two-and-a-half years. I think they are mistaken. New Zealanders are not so stupid as National appears to believe.